Tomasz Góra have been present on the market of investment properties 14 years respectively.

We develop

We build

We create

We build

We create

Market Monitoring

We perform broadly defined possibility analyses and we select, negotiate, take over, carry out, and commercialise renovation works.

Capital Management

For years, we have carried out real estate development projects using outside capital, at the same time establishing and maintaining good relationships with investors.

Investment Process

We make identification and carry out a preliminary study. The following stages include negotiations of boundary conditions and financing structuring.

Tomasz Góra

Many years of expertise in project analysis, preparation of financial structures, and implementation of real estate development investments. He has run his own businesses for twenty-six years, specialising in finance, investments, and large real estate. Today, he is the President of RevisitHome and the driving force behind MountNut ASI, i.e. democratisation of access to renovation and development projects in Łódź. Tomasz is a visionary, skilfully combining earning money with making the world around him a better place.

See more on RevisitHome.pl

We have already carried out six projects with the total value of more than PLN 22,000,000. Work on other investments is underway.

We are carrying out projects the total value of which exceeds PLN 240,000,000. We build our common future. Join us.

Flagship projekcts

A Common Target

We have worked together under the common name of RevisitHome since 2016. As part of the 100kamienic.pl project, we have already completed six projects with the total value of more than PLN 22,000,000.

Our Activities

We Create and We Earn

We monitor the market, analyse possibilities, select, negotiate, take over, carry out, and commercialise renovation works.

But we mostly make money with our investors.

But we mostly make money with our investors.

Capital Management

We have been implementing real estate development projects using outside capital for years, which is why establishing and maintaining relationships with investors is the core element of our business.

Basing on our experience, we have decided to reach a broader market with an investment offer in the form of shares in a company that will invest in a repeatable way.

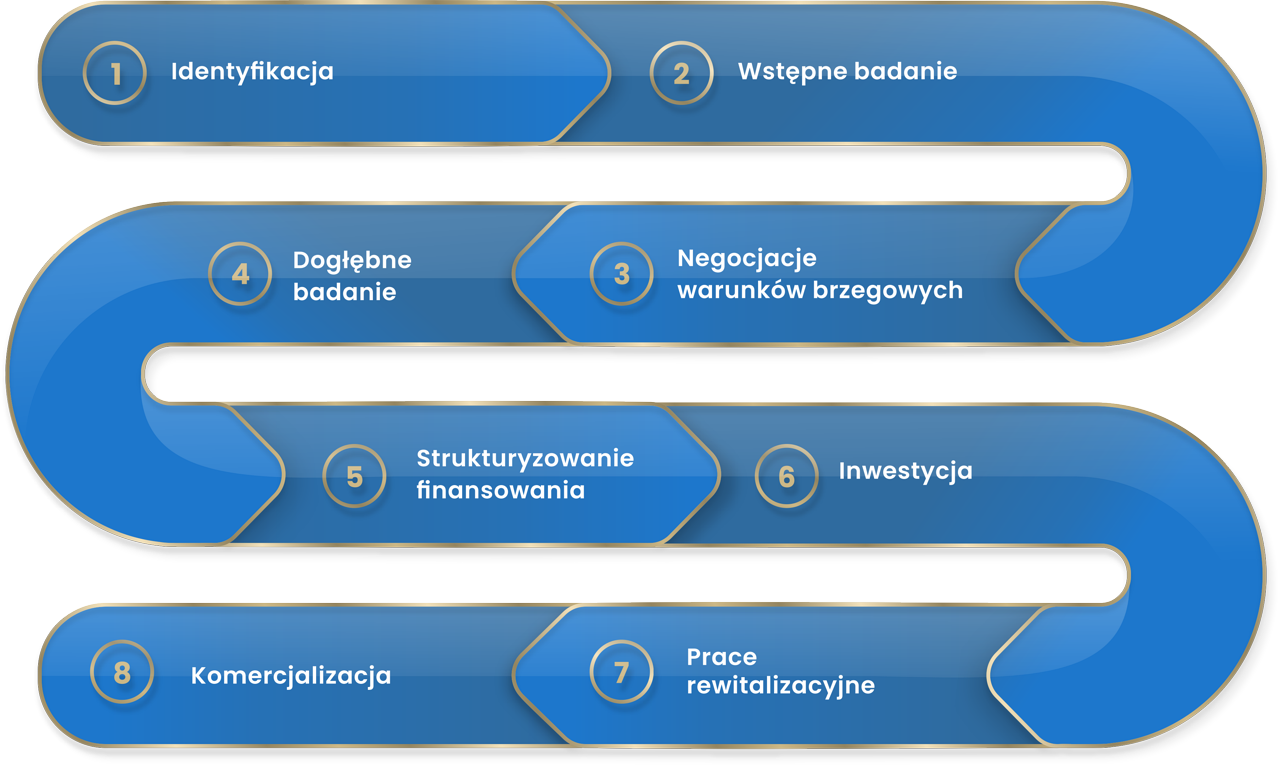

Investing Process

- Identification

- A preliminary study

- Negotiations of boundary conditions

- An in-depth study

- Investment

- Financing structuring

- Renovation work

- Commercialisation

Why Is It Worth Investing?

-

Experienced specialists

A proven management team with a rich history of achievements in many fields of business.

-

Low saturation of the market

of residential real estate in Poland, particularly in the Łódź Province, and a small metric area compared with the EU average.

-

Capital value protection

in the conditions of low interest rates, high inflation, and high valuation of assets.

Investment strategy

Beauty and profit

We monitor the market, analyse possibilities, select, negotiate, take over, carry out, and commercialise renovation works.

The main categories of investments include stocks, shares, and ownership titles to real estate, with the option of investing in the following kinds and types of titles:

- Shares in limited liability companies,

- Stocks of joint-stock companies,

- Rights and obligations arising from the status of a partner of a partnership,

- Bonds, bills of exchange,

- Cash liabilities,

- Ownership or co-ownership of real estate including land properties, buildings, and premises constituting a separate real property.

The Company can give loans, also to natural persons, and, as part of financial liquidity management, it can invest assets in money market instruments and bank deposits.

The Company makes investments

in such areas as:

in such areas as:

- Residential construction

- Commercial construction

- Occasional lease

- Long-term lease

- Dedicated real estate sector services

The Company can only take out loans if:

- The interest rate is arm’s length,

- The maximum repayment period of the loan is 36 months,

- The total amount of loans does not exceed 50% of the amount of the Company’s assets as of the day of taking out the loan.

MOUNTNUT INVESTMENT makes investments in the territory of the Republic of Poland, particularly in the Łódź Province.

All investors are invited to join our projects, regardless of their present place of stay or residence.

Contact Us

Earn

With Us

With Us

We are looking forward to doing business with you.

Contact us and discover our offer or leave your contact details using the contact form. We will contact you as soon as possible.

MOUNTNUT INVESTMENT

Sp. z o.o. ASI Sp. k.a

ul. Kpt. Pilota Żwirki 17

90-539 Łódź, Poland

KRS: 0000822196

Tax Identification Number (NIP): 7272840700

REGON: 385221665

ASI Partnerships

ZASI – MOUNTNUT INVESTMENT SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

manages:

Mountnut Investment spółka z ograniczoną

odpowiedzialnością MR3 alternatywna spółka inwestycyjna

spółka komandytowo-akcyjna.

Mountnut Investment spółka z ograniczoną

odpowiedzialnością alternatywna spółka inwestycyjna

spółka komandytowo-akcyjna.

Mountnut Investment spółka z ograniczoną

odpowiedzialnością Real Estate alternatywna spółka inwestycyjna

spółka komandytowo-akcyjna.